Why Buy Now Pay Later are Crucial to Dubai's E-Commerce Development

More Blogs

In Dubai, the checkout page is no longer a barrier to the sale but a main source of income now. The game-changing secret for e-commerce companies in the UAE is the integration of payment methods of the next generation, especially the Buy Now Pay Later (BNPL) solutions of Tabby and Tamara. These regional giants are significantly altering the consumer spending in Dubai by substantially boosting the conversion rates and Average Order Value (AOV) of the retailers.

Get a free quote for Tabby & Tamara integration

Buy Now Pay Later in the Dubai digital market

The UAE's fast-growing digital economy has created a customer base that demands not only instant gratification but also financial flexibility. For the modern mobile-first consumer, the traditional credit models are often too strict and interest-heavy. Buy Now Pay Later facilities like Tabby and Tamara have removed this barrier by offering a simple, interest-free alternative. With these apps, the customers can practically divide a purchase into four easy, interest-free installments. By getting the total payment upfront, it is safer for the merchant and cash flow is instantly improved. This pattern fits perfectly to the Dubai retail world where the clientele wants both luxury items and the ability to spend wisely.

Conversion: Converting Browsers into Buyers

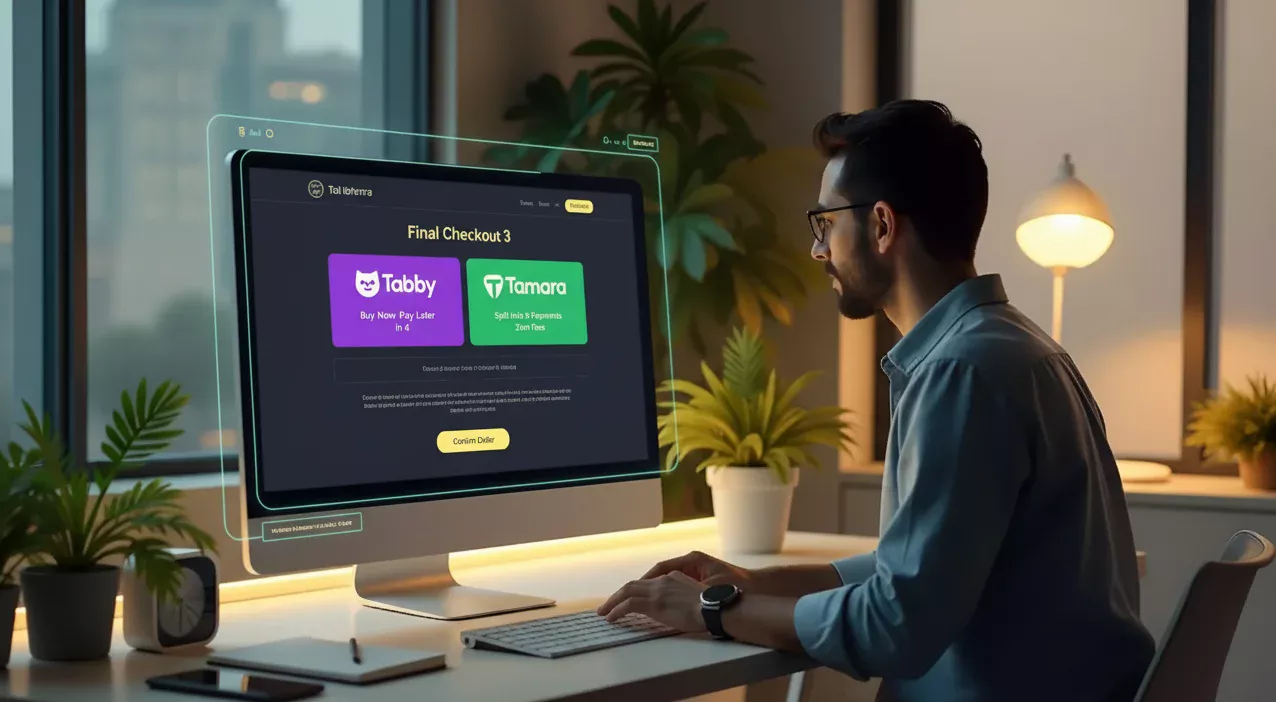

For any online seller, cart abandonment is the major issue. Every day when a customer sees the final high price at the checkout, and he hesitates, and just walks away. This is called "sticker shock". Buy Now Pay Later in Dubai is addressing this problem directly:

- Barrier Reduction: BNPL makes a big upfront cost an inconvenience that can be eliminated by presenting a smaller, weekly installment price (like, "Pay in 4 easy payments of AED 150"). This psychological release has been confirmed as a factor that leads to increased checkout completion.

- Conversion Lift: By simply listing Tabby or Tamara as an obvious payment method, the UAE e-commerce sites often report a significant up to 30% increase in conversion rates, thus making Buy Now Pay Later a necessary part of any strategy for Dubai's e-commerce growth.

Increasing Customer Loyalty & Average Order Value (AOV)

These innovative payment solutions do not just complete a sale but also encourage customers to spend more. When customers realize that they can break the payment into several parts, they tend to go for the higher-priced product or add more items to their order. This convenience has been observed to increase a retailer's average order value by up to 50%.

Moreover, reliance on local reputable suppliers creates a solid bond of loyalty with the customers. The Sharia-compliant, interest-free business model of local players like Tamara is very popular among the customers in the Gulf. In the highly competitive Dubai market, a pleasant payment process is one of the factors that contribute to customer retention and increases the merchant's Customer Lifetime Value (CLV).

Seamless Integration

Offering Buy Now Pay Later has become a must for retailers to compete in Dubai’s retail market, not just a luxury. Contemporary payment gateways and expert web development partners like CLOUD6 make the integration smooth and usually require minimal effort:

- Product Page Visibility: The installment option should be well-visible on the product page to stimulate early sales.

- Frictionless Checkout: To avoid further delays, a no-click sign-up or instant approval method should be applied at the end.

- Risk Mitigation: The BNPL provider takes full responsibility for credit and fraud risk and quickly reimburses the retailer in full.

Businesses in Dubai are future-proofing their e-commerce strategy by giving priority to these sophisticated payment integrations, turning their checkout process from a liability into a growth and conversion engine.

Conclusion

The e-commerce players of Dubai must not consider the integration of Tabby and Tamara as a luxury but as a need for the maximum sales performance of their businesses. In the digital market, they will provide the highest flexibility, trust, and conversion effect that is unmatched.

Building a strategic partnership with a skilled ecommerce web development firm will be the best step for the companies to gain the most from this power. In the fast-paced retail market of the UAE, this partnership assures a smooth, secure, and completely optimized implementation that transforms curious browsers into confident, valuable, and repeat customers.

In the GCC and UAE, Tabby and Tamara are the leading Buy Now Pay Later (BNPL) systems that can be found. They allow the customers to pay the total amount in four equal parts without adding interest and getting their order at once, they are therefore necessary for the e-commerce of Dubai.

The incorporation of these BNPL options not only decreases cart abandonment by as much as 30% but also increases conversion. The buyers perceive the product price much less as a full amount when it is displayed both on the product page and during checkout as being split into small and manageable installments ("4 payments of AED X"). A professional ecommerce web development company ensures not only a seamless and rapid integration but also the reduction of any technical issues that may lead to cart abandonment.

An ecommerce web development company is required because the integration involves complex API (Application Programming Interface) implementation and security protocols.

Tabby integration depends upon the platform which you are using. For languages like Python, tabby integration in Dubai is expensive when compared to integrating with platforms like Shopify.

Tamara integration in Dubai depends on the ecommerce platform that you are currently using. Contact us to get a quote for Tabby integration in Dubai.